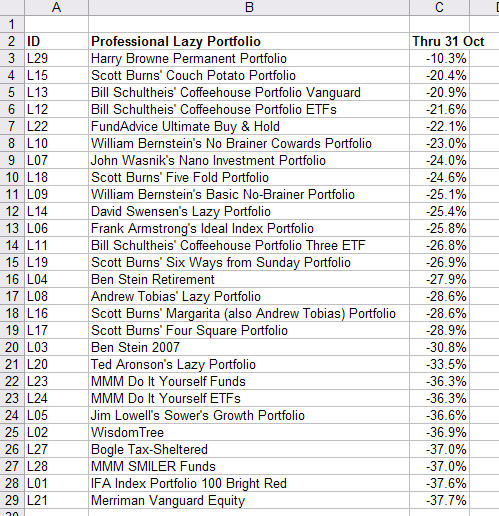

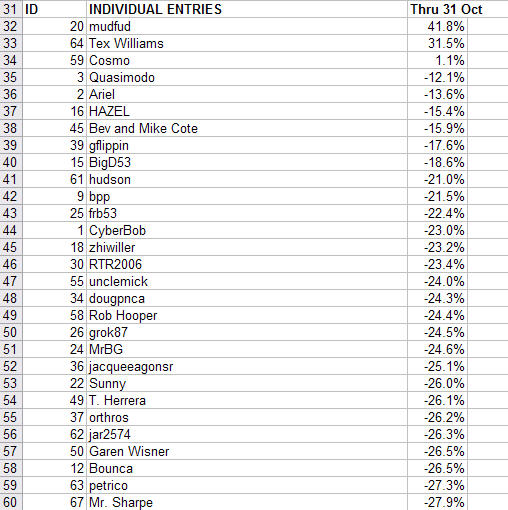

Lazy Portfolio Smackdown Update for 31 Oct 2008

Take a deep breath.

Pull the covers up over your head.

Don’t look.

Well… how about just a little peek?

After ten months of this relentless bear market nonsense, the leader of the professional lazy portfolios has a return of -10.3%. That’s the Harry Browne Permanant Portfolio which bests the rest by at least 10% so far this miserable year. The secret to its “success?” It’s 25% each in Total US Stock Market, 20-year bonds, treasuries, and gold. The average of the 27 “professional” lazy portfolios is -28.5%.

Ah, but the leader of the individual entries? How about a positive 41.8%! Of course that’s our non-diversified, anti-china gambler mudfud with his china bear fund. The other winner is Mr. UltraShort himself, Tex Williams, with 80% of his portfolio in ultrashort ETF bets. Most everybody else is playing the game to go long the market for a long time, and is savagely to the down side where they are suppose to be. hahaha. The average of the individual entries is -28.0%

A reminder of what this game is all about for those of you who are new here. At the beginning of 2008, I asked people to design a portfolio of index funds or ETFs that will exhibit the highest Sharpe Ratio by the end of the year. (I didn’t put it in exactly those terms at the time, but now I realize that’s what I meant.) Winners in three risk bands (less than 8%, 8% to 16%, and 16% plus) get a free copy of Index Funds: The 12-Step Program for Active Investors by Mark Hebner. I’m hoping Foliodex.com will be working in early 2009 to help me compute the Sharpe Ratios. Otherwise, I have a handy spreadsheet ready.