Longer Term Look at Gold in a Portfolio

The previous post looked at the effect of gold in a portfolio for the 10-year period 1990-2009. Some may say that 10 years is not statistically long enough to be meaningful. So in this post I take a look at the 38 years from 1972 through 2009.

To start, I selected a widely-followed portfolio of stocks and bonds. The Fund Advice Vanguard Moderate portfolio has the following composition:

| Fund | Symbol | % |

| Large Cap Value | VIVAX | 6 |

| Large Cap Blend | VFINX | 6 |

| Small Cap Value | VISVX | 6 |

| Small Cap Blend | NAESX | 6 |

| REIT | VGSIX | 6 |

| Int’l Developed | VDMIX | 12 |

| Emerging Mkt | VEIEX | 6 |

| Int’l Value | VTRIX | 12 |

| 5 Yr. T-Bills | VFITX | 20 |

| TIPS | VIPSX | 8 |

| 2 Yr Treasury | VFISX | 12 |

(Fund Advice recently split their recommended 12% of VDMIX into 6% VDMIX and 6% VFSVX, the All-World ex-US Small Cap index.)

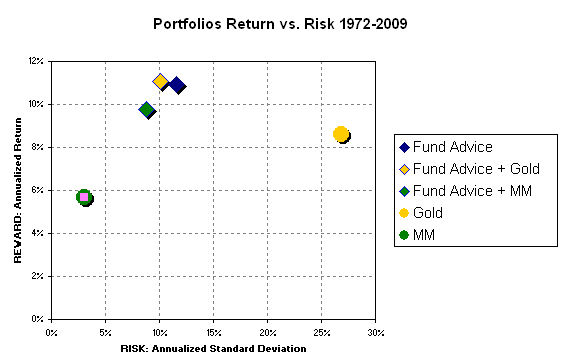

The Fund Advice portfolio placed 32% in fixed-income and 68% in equities. For the period 1972 through 2009, the portfolio achieved a compound annual growth rate (CAGR) of 10.95% with a standard deviation (risk) of 11.6%. This works out to a Sharpe ratio of 0.51.

Let’s now see what would have happened if instead of 100%, we placed 75% of our investment in the Fund Advice portfolio and the remaining 25% in gold. We would have achieved a CAGR of 11.09%, a risk of 10.08%, and a Sharpe ratio of 0.58. So gold did add to the returns for the period while reducing the risk. How could that be since gold itself was very risky over the period? Gold by itself returned only 8.62% while being a whopping 26.88% risky.

How about instead of investing the 25% in risky gold, we had placed the 25% in safe but similarly rewarding Treasury Money Market fund? The Vanguard VMPXX by itself for 1972 through 2009 had a CAGR of 5.66% with a risk of only 3.03%. The resulting combination with the Fund Advice portfolio shows a CAGR of 9.75%, a risk of 8.77%, and a Sharpe ratio of 0.5.

The return vs. risk of the three portfolio mixes and the individual components gold and money market (MM) are shown in the following graph.

| Portfolio | CAGR | Risk | Sharpe |

| Fund Advice | 10.95% | 11.60% | 0.51 |

| Fund Advice + Gold | 11.09% | 10.08% | 0.58 |

| Fund Advice + Money Market | 9.75% | 8.77% | 0.50 |

So against our intuition, investing in risky gold actually reduced risk in the overall portfolio while adding to the returns. It even beat a comparable portfolio that invested in money markets. This is the power of Modern Portfolio Theory in action showing that while some assets zig, others zag to combine in wonderful ways.

Sources: Vanguard.com, Simba’s spreadsheet (with 2009 data added), Bogelheads.org, FundAdvice.com.